Get insurance quote usaa – Get a USAA insurance quote is a critical step for individuals seeking financial protection and peace of mind. USAA, a renowned financial services company, has a long history of serving the military community and their families. Offering a wide range of insurance products, including auto, home, life, and renters, USAA is known for its competitive rates, excellent customer service, and unique benefits tailored to its members.

This comprehensive guide delves into the process of obtaining a USAA insurance quote, highlighting key factors that influence pricing and providing insights into USAA’s offerings.

Whether you’re a current or former military member, a family member of a service member, or a USAA member seeking a new quote, understanding the intricacies of USAA’s insurance process is crucial. This guide aims to provide clarity and empower you with the knowledge needed to navigate the quote process effectively, ultimately enabling you to make informed decisions about your insurance needs.

Understanding USAA Insurance

USAA is a financial services company that provides insurance and other financial products to members of the U.S. military, their families, and those who have served. Founded in 1922 by a group of Army officers in San Antonio, Texas, USAA has a long history of serving the military community.

History and Background of USAA

USAA was initially formed as a mutual company, owned by its members. This means that policyholders are also the owners of the company. The company’s mission has always been to provide financial services to military members and their families, offering competitive rates and excellent customer service.

USAA’s focus on the military community has allowed it to build a strong brand reputation and develop a loyal customer base.

Types of Insurance Offered by USAA

USAA offers a wide range of insurance products, including:

- Auto Insurance: USAA provides comprehensive auto insurance coverage, including liability, collision, and comprehensive coverage. They also offer a variety of discounts, such as good driver discounts and military discounts.

- Homeowners Insurance: USAA offers homeowners insurance to protect your home and belongings against damage from various perils, including fire, theft, and natural disasters.

- Renters Insurance: USAA provides renters insurance to protect your personal belongings in case of theft, damage, or other unforeseen events.

- Life Insurance: USAA offers various life insurance products, including term life insurance, whole life insurance, and universal life insurance.

- Health Insurance: USAA offers health insurance plans through its partnership with Humana.

- Other Insurance Products: USAA also provides other insurance products, such as motorcycle insurance, boat insurance, and flood insurance.

Target Audience and Membership Requirements

USAA’s primary target audience is members of the U.S. military, their families, and those who have served. To become a USAA member, you must meet one of the following criteria:

- Active-duty military personnel: This includes members of the Army, Navy, Air Force, Marines, Coast Guard, and Space Force.

- Retired military personnel: This includes veterans who have served at least 20 years in the military.

- Spouses and dependents of active-duty or retired military personnel: This includes spouses, children, and other dependents.

- Cadets and midshipmen: This includes students enrolled in military academies.

- Former military personnel: This includes veterans who have served at least one day in the military.

Obtaining a USAA Insurance Quote

Getting a quote for USAA insurance is a straightforward process that can be completed online, over the phone, or in person. The company offers a variety of insurance products, including auto, home, renters, life, and health insurance.

Methods for Obtaining a Quote

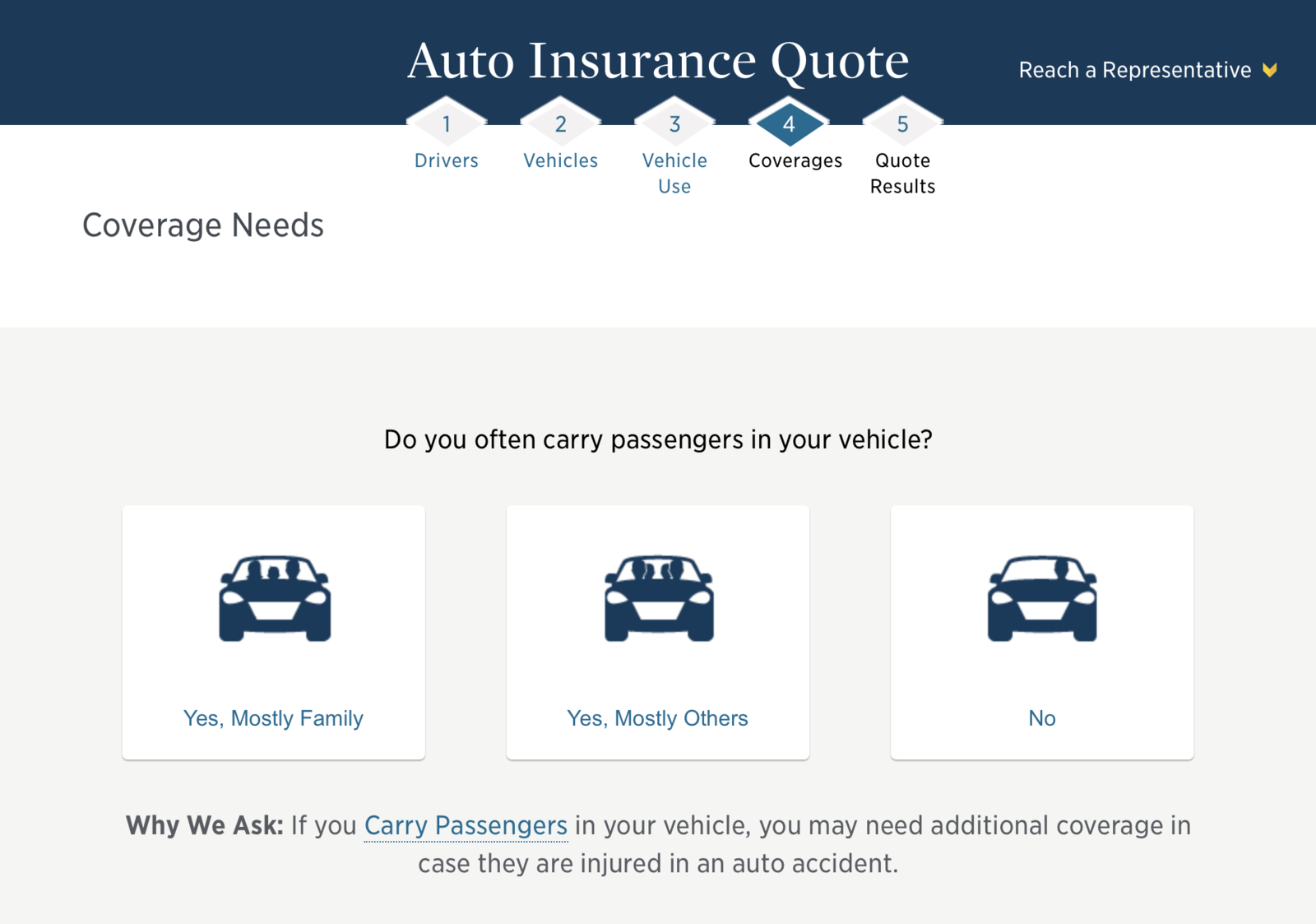

To get a quote, you will need to provide some basic information about yourself and your insurance needs. The specific information required will vary depending on the type of insurance you are seeking.

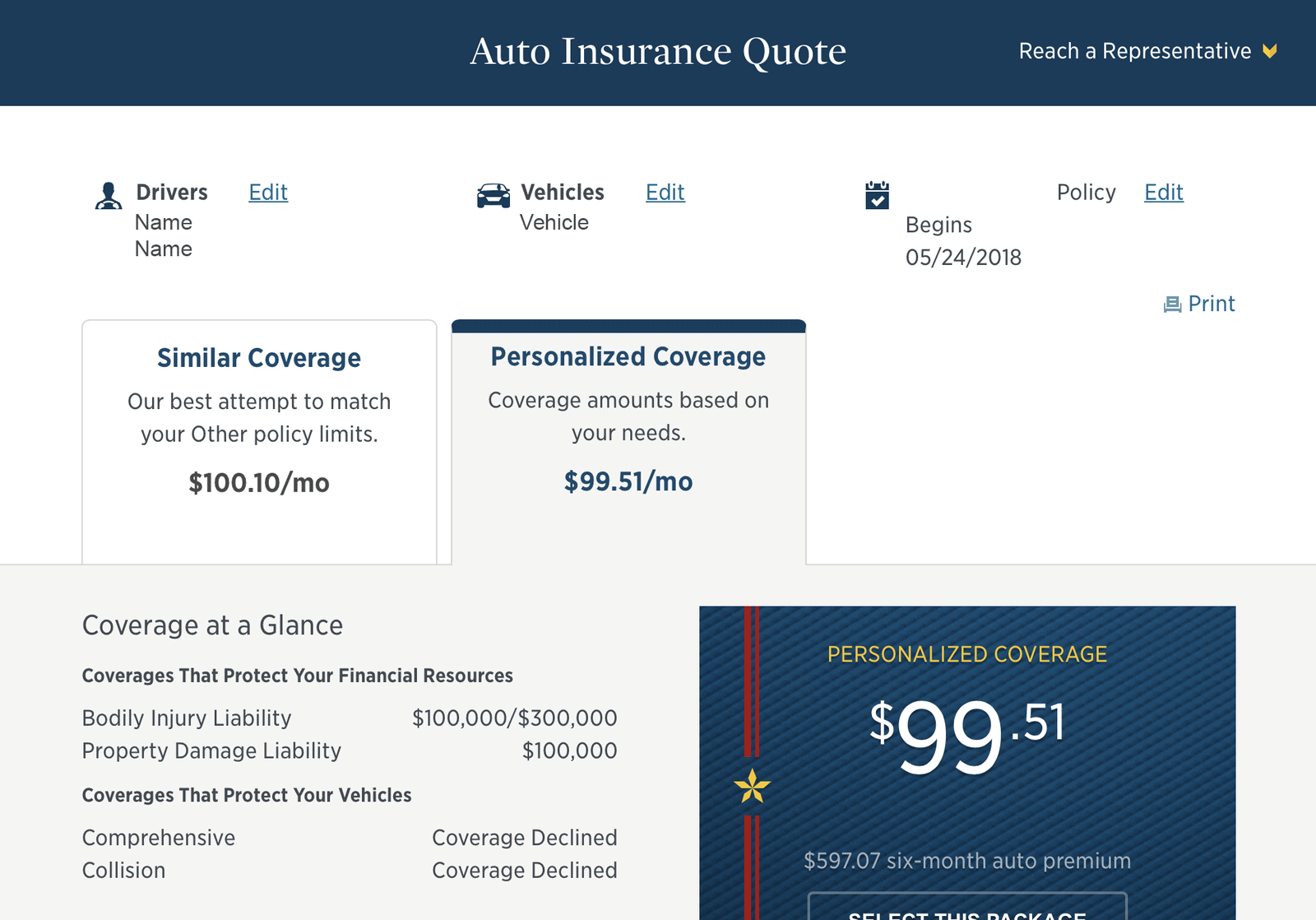

- Online:USAA’s website offers a user-friendly online quoting system that allows you to receive an instant quote for most insurance products. You can access the online quoting system by visiting the USAA website and clicking on the “Get a Quote” button.

The online quoting system allows you to customize your coverage options and receive an instant quote tailored to your specific needs.

- Phone:You can also get a quote by calling USAA’s customer service line. A USAA representative will ask you a series of questions about your insurance needs and provide you with a quote. This method allows you to speak directly with a representative and ask any questions you may have about the quote process.

- In Person:USAA also has physical offices located throughout the United States. You can visit a USAA office in person to obtain a quote. This option allows you to speak with a USAA representative face-to-face and discuss your insurance needs in detail.

Information Required for a Quote

The specific information you need to provide for a quote will vary depending on the type of insurance you are seeking. However, some common information requirements include:

- Personal Information:This includes your name, address, date of birth, and social security number.

- Vehicle Information:If you are getting a quote for auto insurance, you will need to provide information about your vehicle, such as the make, model, year, and VIN. You may also need to provide information about your driving history, such as your driving record and any accidents or violations.

- Home Information:If you are getting a quote for home insurance, you will need to provide information about your home, such as the square footage, age, and construction materials. You may also need to provide information about any security features, such as alarms or security cameras.

Comparison of Quote Processes for Different Insurance Types

The quote process for different insurance types is generally similar, but there are some key differences.

- Auto Insurance:For auto insurance, you will need to provide information about your vehicle, driving history, and coverage preferences. USAA offers a variety of auto insurance coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Home Insurance:For home insurance, you will need to provide information about your home, coverage preferences, and any special features or risks associated with your home. USAA offers a variety of home insurance coverage options, including dwelling, personal property, liability, and additional living expenses coverage.

- Renters Insurance:For renters insurance, you will need to provide information about your rental property, personal belongings, and coverage preferences. USAA offers a variety of renters insurance coverage options, including personal property, liability, and additional living expenses coverage.

USAA Insurance Quote Factors

USAA considers several factors when calculating your insurance premium. These factors can significantly influence the final cost of your policy, so it’s essential to understand how they impact your quote.

Driving History

Your driving history plays a crucial role in determining your insurance premium. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly increase your insurance costs.

For instance, a driver with multiple speeding tickets or a DUI conviction might face higher premiums compared to a driver with a clean record.

Credit Score, Get insurance quote usaa

While not always a direct factor, your credit score can indirectly influence your insurance premium. Insurance companies use credit scores to assess risk, and individuals with higher credit scores are generally considered less risky. This can lead to lower premiums for those with good credit.

For example, a person with a high credit score might qualify for a lower premium compared to someone with a lower credit score, even if they have similar driving records.

Location

The location where you live can significantly impact your insurance premium. Factors like population density, crime rates, and the frequency of accidents in your area can influence your insurance costs.

For instance, drivers living in urban areas with high traffic congestion and a higher likelihood of accidents may face higher premiums compared to those residing in rural areas with less traffic and lower accident rates.

USAA Insurance Features and Benefits

USAA is known for its comprehensive insurance offerings and exceptional customer service. In addition to standard insurance coverage, USAA provides various features and benefits designed to enhance policyholders’ experience and provide peace of mind.

Getting an insurance quote from USAA can be a straightforward process, but it’s important to schedule time for it in your calendar. You can use a August 2024 Calendar Template to mark down when you plan to call or visit USAA’s website.

Once you have your quote, you can compare it with other insurance providers and make the best decision for your needs.

Customer Service and Claims Handling

USAA prioritizes customer satisfaction by offering dedicated support and streamlined claims processes. Policyholders can access 24/7 customer service through various channels, including phone, email, and online chat. USAA’s claims handling process is known for its efficiency and transparency. The company aims to resolve claims quickly and fairly, with dedicated claims adjusters available to assist policyholders throughout the process.

Unique Features

USAA offers several unique features that differentiate its offerings from other insurance providers.

Roadside Assistance

USAA’s roadside assistance program provides comprehensive support for policyholders facing unexpected vehicle breakdowns or emergencies. This program includes services like:

- Towing

- Flat tire changes

- Jump starts

- Fuel delivery

- Lockout assistance

These services can be accessed 24/7, providing peace of mind for policyholders who may find themselves stranded on the road.

Accident Forgiveness

USAA’s accident forgiveness program is a valuable feature that can protect policyholders from premium increases following their first at-fault accident. This program allows policyholders to avoid a premium surcharge on their policy, providing financial protection and reducing the financial burden associated with accidents.

Discounts

USAA offers a wide range of discounts to help policyholders save money on their premiums. Some common discounts include:

- Good driver discount

- Multi-policy discount

- Safe driver discount

- Military discount

- Bundling discount

By taking advantage of these discounts, policyholders can significantly reduce their overall insurance costs.

Comparison with Other Insurance Providers

While USAA is highly regarded for its customer service, features, and benefits, it’s important to compare its offerings with other insurance providers to determine the best fit for individual needs and budgets. Other insurance providers may offer similar features and benefits, but USAA’s focus on military families and its commitment to customer service distinguish it as a strong contender in the insurance market.

USAA Insurance Reviews and Ratings

USAA, a financial services company primarily serving members of the U.S. military and their families, has consistently earned high marks for its insurance products and services. To understand USAA’s standing, it’s essential to examine both customer reviews and independent ratings agencies.

Customer Reviews

Customer reviews provide valuable insights into the real-world experiences of USAA insurance policyholders.

- USAA consistently receives high ratings on popular review platforms such as Trustpilot and Consumer Affairs. Many customers praise USAA’s excellent customer service, competitive rates, and quick claims processing.

- However, some reviews highlight occasional issues with online account access or long wait times for phone support. Despite these minor drawbacks, the overall sentiment towards USAA insurance is overwhelmingly positive.

Independent Ratings

Independent rating agencies play a crucial role in assessing the financial strength and customer satisfaction of insurance companies.

- AM Best, a leading credit rating agency specializing in the insurance industry, assigns USAA an A++ (Superior) financial strength rating. This indicates that USAA has a very strong ability to meet its financial obligations.

- J.D. Power, a global marketing information services company, has consistently ranked USAA highly in its annual auto insurance satisfaction surveys. In 2023, USAA received the highest score among all insurance companies, demonstrating its exceptional customer experience.

Financial Stability and Customer Satisfaction

USAA’s financial strength and customer satisfaction are interconnected.

- A financially sound company can provide greater stability and security for its policyholders. USAA’s strong financial ratings indicate its ability to withstand economic downturns and continue to meet its policy obligations.

- High customer satisfaction levels often translate into a loyal customer base. USAA’s focus on providing exceptional service and competitive rates has fostered a strong sense of loyalty among its members.

Pros and Cons of Choosing USAA Insurance

Choosing an insurance company is a significant decision, and it’s essential to weigh the pros and cons carefully.

Getting an insurance quote from USAA can be a straightforward process, especially if you’re a member of the military or a veteran. To stay organized with your insurance needs and any deadlines, you might find a printable calendar helpful, like the August 2024 Calendar Printable , which can help you track important dates and appointments.

Once you’ve secured your USAA insurance, remember to keep your policy information readily available in case you need to make a claim.

- Pros:

- Competitive rates: USAA often offers competitive rates, especially for members with good driving records.

- Excellent customer service: USAA is renowned for its exceptional customer service, with dedicated representatives available 24/7.

- Financial stability: USAA’s strong financial ratings provide confidence in its ability to meet policy obligations.

- Exclusive benefits: USAA offers a range of exclusive benefits to members, such as discounts for military families and access to specialized services.

- Cons:

- Eligibility restrictions: USAA insurance is only available to members of the U.S. military, their families, and certain affiliated individuals.

- Limited availability: USAA’s insurance products are not available in all states.

- Potential wait times: While USAA provides excellent customer service, occasional wait times for phone support can occur.

Getting Started with USAA Insurance: Get Insurance Quote Usaa

Getting started with USAA insurance is a straightforward process that begins with an application. To apply, you’ll need to provide some personal information and documentation. Once you’ve submitted your application, USAA will review it and provide you with a quote.

Applying for USAA Insurance

To apply for USAA insurance, you’ll need to provide some basic information, including your contact details, driving history, and vehicle information. The process is typically online or through a USAA agent.

Required Documents and Information

| Document/Information | Description |

|---|---|

| Proof of Identity | Driver’s license, passport, or military ID |

| Social Security Number | Used for verification purposes |

| Vehicle Information | Make, model, year, VIN, and mileage |

| Driving History | Proof of insurance, driving record, and accident history |

| Contact Information | Phone number, email address, and mailing address |

Setting Up an Account and Managing Policies

Once you’ve applied for USAA insurance, you’ll need to set up an account to manage your policies.

Steps for Setting Up an Account and Managing Policies

- Create an Account:You can create an account online or by contacting a USAA agent. You’ll need to provide your personal information and create a username and password.

- Review and Accept Your Quote:Once you’ve received a quote, you can review it and accept it online or by contacting a USAA agent.

- Make Your First Payment:You’ll need to make your first payment to activate your policy.

- Manage Your Policy:You can manage your policy online, by phone, or through a USAA agent. You can make payments, update your contact information, and file claims.

Closing Notes

In conclusion, getting a USAA insurance quote is a straightforward process that can be completed online, over the phone, or in person. By understanding the key factors that influence pricing, exploring the unique features and benefits offered by USAA, and considering customer reviews and ratings, you can determine if USAA is the right insurance provider for your needs.

Whether you’re seeking auto, home, life, or other insurance coverage, USAA’s reputation for reliability, competitive pricing, and exceptional customer service makes it a compelling option for military families and their extended network.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/6ZSXS37WCJABPPHK7A5HJAQBAY)