Financial Plans for Retirement and Other Goals are essential for securing a comfortable future and achieving your aspirations. From navigating retirement savings options to managing debt and investing wisely, a comprehensive financial plan empowers you to take control of your financial well-being.

This guide provides a step-by-step approach to crafting a plan that aligns with your individual needs and goals, ensuring you’re on track to achieve financial independence.

Understanding your current financial situation is the cornerstone of any successful plan. This involves analyzing your income, expenses, assets, and liabilities. Once you have a clear picture of your financial landscape, you can set realistic goals and timelines for achieving them.

Whether it’s retiring comfortably, buying a home, funding your children’s education, or simply achieving financial peace of mind, a well-structured plan provides the roadmap to navigate your financial journey.

Understanding Financial Planning Basics

Financial planning is a crucial aspect of achieving long-term financial security and realizing your financial goals. It involves setting clear objectives, creating a roadmap to reach those objectives, and taking proactive steps to manage your finances effectively. Whether it’s planning for retirement, purchasing a home, funding your children’s education, or simply achieving financial independence, a well-structured financial plan provides a framework for success.

The Importance of Financial Planning

Financial planning helps you gain control over your financial future by providing a structured approach to managing your income, expenses, and assets. It allows you to:

- Set clear and achievable financial goals.

- Develop a personalized strategy to achieve those goals.

- Track your progress and make necessary adjustments along the way.

- Reduce financial stress and anxiety.

- Maximize your savings and investments.

- Protect your assets from unforeseen events.

Creating a Personal Financial Plan

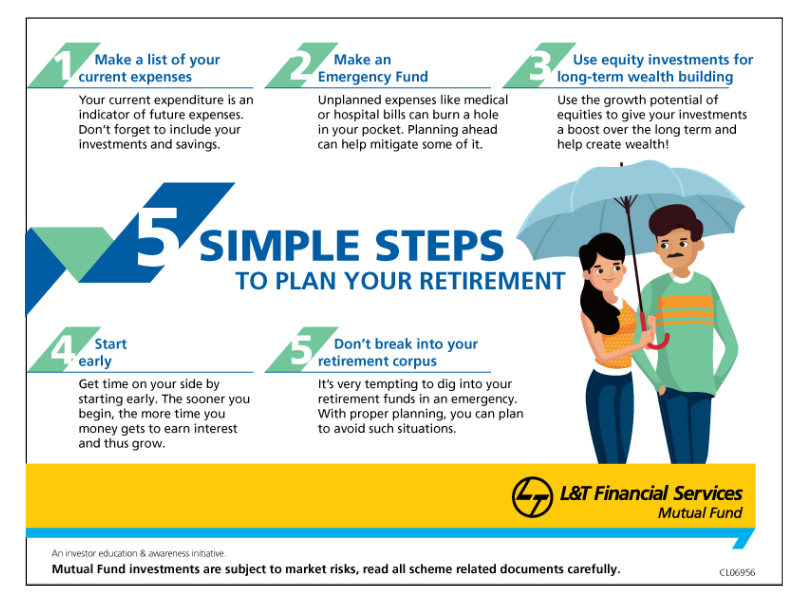

Developing a comprehensive financial plan involves several key steps:

- Assess Your Current Financial Situation:Begin by gathering information about your income, expenses, assets, and liabilities. This step involves analyzing your bank statements, credit card statements, investment accounts, and any outstanding debts.

- Define Your Financial Goals:Identify your short-term and long-term financial goals, such as retirement, homeownership, education, or travel. Clearly define the time frame for achieving each goal and the estimated cost involved.

- Create a Budget:Develop a detailed budget that Artikels your income and expenses. Track your spending habits and identify areas where you can cut back or allocate funds more effectively.

- Plan for Retirement:Determine your desired retirement lifestyle and calculate the amount of savings needed to achieve it. Consider factors like age, expected life expectancy, and inflation.

- Develop an Investment Strategy:Based on your risk tolerance and financial goals, choose appropriate investment options. Consider a diversified portfolio that includes stocks, bonds, real estate, and other assets.

- Manage Debt:Develop a strategy to pay off high-interest debt, such as credit card debt, and prioritize debt repayment based on interest rates and loan terms.

- Protect Your Assets:Implement measures to safeguard your assets from unforeseen events, such as illness, disability, or death. Consider insurance policies like health insurance, life insurance, and disability insurance.

- Review and Adjust Regularly:Periodically review your financial plan to ensure it aligns with your changing circumstances and goals. Adjust your budget, investment strategy, and debt management plan as needed.

Setting Realistic Financial Goals and Timelines

Setting realistic financial goals is crucial for motivation and success. Consider these tips:

- Be Specific and Measurable:Clearly define your goals with specific targets and timeframes. For example, instead of “save for retirement,” set a goal like “accumulate $1 million in retirement savings by age 65.”

- Prioritize Your Goals:Rank your goals based on importance and urgency. Focus on achieving your most important goals first.

- Consider Your Time Horizon:Long-term goals, such as retirement, require a longer time horizon and may involve a lower risk tolerance. Short-term goals, like saving for a down payment on a home, can be achieved with a shorter time frame and potentially higher risk.

Financial plans for retirement and other goals often involve a mix of investments and insurance. For military members, protecting assets like boats is crucial, and USAA offers tailored insurance options. A thorough understanding of your coverage needs is essential, and Boat Insurance Quote USAA: A Guide for Military Members provides valuable insights into USAA’s offerings.

By ensuring your assets are protected, you can focus on achieving your long-term financial objectives with confidence.

- Break Down Large Goals into Smaller Steps:Divide large, daunting goals into smaller, more manageable steps. This approach can make the process feel less overwhelming and increase your sense of accomplishment as you progress.

- Stay Flexible and Adapt:Life is unpredictable, and your circumstances can change. Be prepared to adjust your financial plan as needed to accommodate unexpected events or changes in your goals.

Retirement Planning Strategies

Retirement planning involves setting financial goals and developing strategies to achieve them. This includes saving, investing, and managing your finances to ensure you have a comfortable lifestyle during your retirement years.

Retirement Savings Options, Financial Plans for Retirement and Other Goals

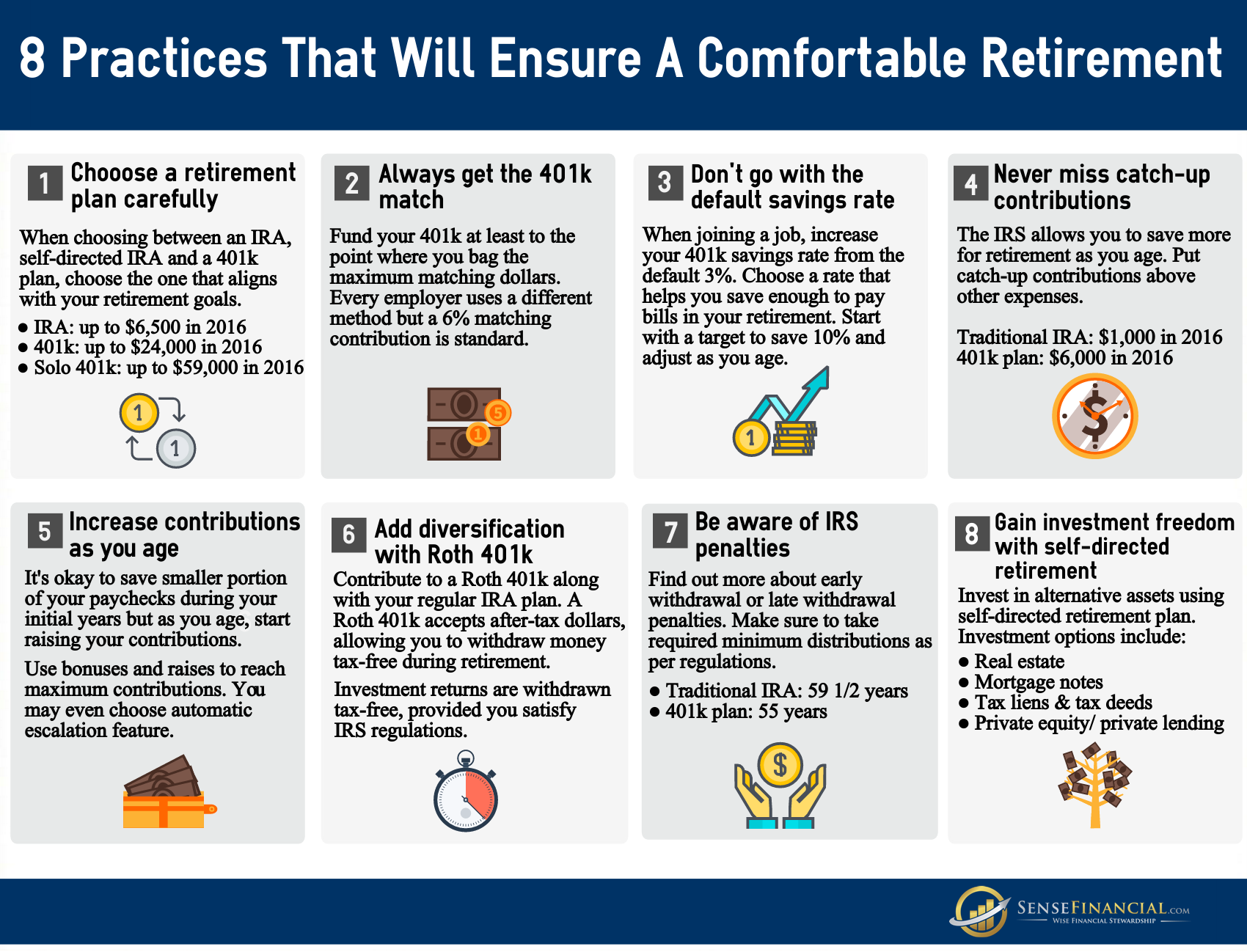

Choosing the right retirement savings plan is crucial for building a secure financial future. Here’s a comparison of popular options:

- 401(k): A defined-contribution plan offered by employers. Employees contribute a portion of their pre-tax salary, which is then invested in a variety of options. Employers may match a portion of employee contributions, providing a valuable benefit.

- Traditional IRA: A retirement savings plan that allows individuals to contribute pre-tax dollars, reducing their current tax liability. Earnings grow tax-deferred, and withdrawals are taxed in retirement.

- Roth IRA: Similar to a traditional IRA, but contributions are made with after-tax dollars. Earnings grow tax-free, and withdrawals in retirement are tax-free.

Benefits and Drawbacks of Retirement Savings Options

Each retirement savings option has its own set of benefits and drawbacks, making it important to carefully consider your individual circumstances before choosing.

| Option | Benefits | Drawbacks |

|---|---|---|

| 401(k) | Employer matching contributions, tax-deferred growth, potential for company stock options. | Limited investment choices, potential for employer-imposed restrictions. |

| Traditional IRA | Tax-deductible contributions, tax-deferred growth, potential for higher contributions than 401(k)s. | Withdrawals before age 59 1/2 are typically subject to a 10% penalty and taxes. |

| Roth IRA | Tax-free withdrawals in retirement, potential for higher earnings growth due to tax-free compounding. | Contributions are not tax-deductible, potential for lower contributions than traditional IRAs. |

Retirement Savings Plan Design

Designing a retirement savings plan involves setting specific contribution goals and investment strategies.

Example:An individual earning $75,000 per year could aim to contribute 15% of their salary to their 401(k) and Roth IRA, totaling $11,250 per year. They could invest 70% of their contributions in a diversified stock portfolio and 30% in a bond portfolio.

Crafting a robust financial plan for retirement and other life goals often involves careful consideration of risk mitigation. Protecting your assets and loved ones through comprehensive insurance coverage is a key component of this strategy. To explore your insurance needs and obtain personalized quotes, consider utilizing the resources available at Get a USAA Insurance Quote: A Comprehensive Guide.

By securing appropriate insurance, you can confidently pursue your financial goals, knowing that you have a safety net in place.

This plan could be adjusted based on factors like age, risk tolerance, and time horizon. It’s important to review and adjust the plan periodically to ensure it aligns with your changing financial goals and circumstances.

Managing Debt and Expenses: Financial Plans For Retirement And Other Goals

Debt can significantly hinder your financial progress, particularly when aiming for long-term goals like retirement. Understanding the various types of debt, their impact on your finances, and effective management strategies is crucial for achieving financial well-being.

Financial planning for retirement and other goals often involves a thorough assessment of assets and liabilities. A significant asset for many is their home, and protecting its value is crucial. Rhode Island homeowners can find valuable information and compare quotes for home insurance through Rhode Island Home Insurance Quotes: A Guide for Homeowners , which can help ensure adequate coverage in case of unforeseen events.

By securing proper insurance, individuals can safeguard their financial well-being and achieve their long-term financial objectives.

Debt Types and Their Impact

Debt is a common financial tool, but it’s essential to manage it responsibly. Different types of debt come with varying interest rates and repayment terms, influencing their impact on your financial planning.

- Credit Card Debt:Often carries high interest rates, making it expensive to carry over balances. Uncontrolled credit card debt can lead to significant interest accumulation, hindering your ability to save for retirement and other goals.

- Student Loan Debt:While often considered “good debt” due to its potential to enhance future earning potential, high interest rates and long repayment terms can strain your budget. Effective planning and management are essential to minimize its impact on your finances.

- Personal Loans:Offer flexible repayment terms and can be useful for various purposes, but they can also come with high interest rates. Prioritize using personal loans for essential needs and avoid taking on excessive debt.

- Mortgage Debt:A significant investment in housing can help build equity but comes with a long-term financial commitment. Strategic planning and budgeting are vital to manage mortgage payments while still achieving other financial goals.

Debt Management Strategies

Several strategies can help you manage debt effectively and regain control of your finances.

- Debt Consolidation:This strategy involves combining multiple debts into a single loan with a lower interest rate, potentially reducing your monthly payments. However, it’s crucial to ensure you can afford the new loan’s terms and avoid taking on additional debt.

- Debt Snowball Method:This approach focuses on paying off the smallest debt first, building momentum and motivation. After each debt is paid off, you roll the payment amount to the next smallest debt, creating a snowball effect. This method can provide a psychological boost and help you stay motivated.

- Debt Avalanche Method:This strategy prioritizes paying off debts with the highest interest rates first, minimizing the overall interest paid over time. While this method can save you more money in the long run, it may require a more disciplined approach and longer-term commitment.

Budgeting for Retirement and Other Goals

Creating a budget that prioritizes saving for retirement and other goals is essential for achieving your financial objectives.

- Track Your Expenses:Start by tracking your spending for a few months to understand your current spending patterns. Categorize your expenses and identify areas where you can cut back.

- Set Financial Goals:Define your short-term and long-term financial goals, including retirement, emergency fund, travel, or education. This will help you allocate your resources effectively.

- Prioritize Saving:Make saving for retirement and other goals a priority in your budget. Consider automating your savings by setting up regular contributions to your retirement accounts or other investment vehicles.

- Review and Adjust:Regularly review your budget and make adjustments as needed. Life circumstances can change, and your financial goals may evolve. Adjusting your budget accordingly ensures you stay on track.

Investing for Retirement and Other Goals

Investing is a crucial component of financial planning, enabling you to grow your wealth over time and achieve your financial goals, including retirement. By investing wisely, you can potentially outpace inflation and secure a comfortable future.

Understanding Investment Options

Investing involves allocating your money to assets with the expectation of generating returns. Different investment options offer varying levels of risk and potential returns.

- Stocksrepresent ownership in publicly traded companies. They offer the potential for high returns but are also subject to market volatility. Stocks are considered a growth investment and are typically suitable for investors with a long-term horizon.

- Bondsare debt securities issued by governments or corporations. They typically offer lower returns than stocks but are generally considered less risky. Bonds are considered a more conservative investment and can provide stability to a portfolio.

- Real Estatecan be a tangible asset that provides potential for both income generation and appreciation. However, real estate investments can be illiquid and require significant capital.

Diversifying Investments

Diversification is a key principle in investing, aiming to reduce risk by spreading investments across different asset classes. By holding a variety of assets, investors can mitigate the impact of any single investment performing poorly.

- Asset Allocationinvolves determining the proportion of your portfolio allocated to different asset classes, such as stocks, bonds, and real estate. The allocation should reflect your risk tolerance, time horizon, and financial goals.

- Sector Diversificationinvolves investing in companies across various industries, reducing reliance on any particular sector’s performance.

- Geographic Diversificationinvolves investing in companies located in different countries, reducing exposure to economic fluctuations in any one region.

Managing Investment Risk

Risk is inherent in investing, but it can be managed through careful planning and diversification.

- Risk Tolerancerefers to your ability and willingness to accept fluctuations in the value of your investments. Investors with a high risk tolerance may be willing to invest in more volatile assets like stocks, while those with a low risk tolerance may prefer more conservative investments like bonds.

- Time Horizonrefers to the length of time you plan to hold your investments. Longer time horizons allow for greater potential for growth, while shorter time horizons may require a more conservative approach.

- Investment Strategyshould align with your risk tolerance, time horizon, and financial goals. It should also be reviewed and adjusted periodically to reflect changes in your circumstances and market conditions.

Portfolio Allocation Strategies

Portfolio allocation is the process of dividing your investment capital among different asset classes based on your individual goals and risk tolerance.

- Conservative Portfolio: A conservative portfolio typically allocates a larger portion to bonds and a smaller portion to stocks. This strategy is suitable for investors with a low risk tolerance or a shorter time horizon. For example, a conservative portfolio might allocate 70% to bonds and 30% to stocks.

- Moderate Portfolio: A moderate portfolio balances risk and return by allocating a moderate portion to both stocks and bonds. This strategy is suitable for investors with a moderate risk tolerance and a medium-term time horizon. A moderate portfolio might allocate 50% to stocks and 50% to bonds.

- Aggressive Portfolio: An aggressive portfolio allocates a larger portion to stocks and a smaller portion to bonds. This strategy is suitable for investors with a high risk tolerance and a long-term time horizon. An aggressive portfolio might allocate 80% to stocks and 20% to bonds.

Rebalancing Your Portfolio

Rebalancing involves adjusting your portfolio’s asset allocation to maintain your desired risk level. Over time, asset classes may fluctuate in value, leading to deviations from your initial allocation. Rebalancing helps ensure that your portfolio remains aligned with your investment goals.

“Rebalancing is the process of adjusting the weights of your investments to bring them back to your target asset allocation.”

Final Review

Crafting a comprehensive financial plan is an ongoing process that requires regular review and adjustments. As your life circumstances change, so too should your financial plan. Staying informed about market trends, investment opportunities, and changes in tax laws is crucial for ensuring your plan remains effective.

By embracing a proactive approach to financial planning, you can build a solid foundation for a secure and prosperous future. Remember, financial planning is not a one-time event, but a continuous journey toward achieving your financial goals and living a fulfilling life.