Finance Coach for Financial Planning and Education is a revolutionary approach to personal finance, offering personalized guidance and support to empower individuals to achieve their financial goals. Unlike traditional financial advisors, a finance coach takes a holistic view of your financial life, considering not just your investments, but also your mindset, behavior, and overall financial well-being.

By combining financial expertise with coaching techniques, finance coaches help individuals identify their financial values, develop actionable strategies, and overcome limiting beliefs that may be holding them back. This personalized approach fosters lasting positive changes in financial behavior, leading to greater financial security and peace of mind.

The Role of a Finance Coach

In today’s complex financial landscape, navigating the intricacies of budgeting, investing, and saving can feel overwhelming. A finance coach serves as a trusted guide, empowering individuals to take control of their financial well-being and achieve their financial goals.

Value Proposition of a Finance Coach

Finance coaches provide a unique value proposition by offering personalized guidance, motivation, and accountability that traditional financial advisors may not always provide. They go beyond simply managing investments; they focus on understanding an individual’s financial goals, values, and behaviors to create a tailored plan that aligns with their overall life aspirations.

Distinct Skills and Expertise

Finance coaches bring a distinct skillset to the table, combining financial knowledge with coaching techniques to create a holistic approach to financial well-being.

- Financial Literacy:Finance coaches possess a strong understanding of financial concepts, including budgeting, investing, debt management, and retirement planning. They can translate complex financial information into understandable terms, empowering individuals to make informed decisions.

- Behavioral Finance:Recognizing that financial decisions are often influenced by emotions and biases, finance coaches are trained to understand and address these psychological factors. They can help individuals overcome procrastination, fear of loss, and other behavioral roadblocks to financial success.

- Coaching Skills:Finance coaches are adept at active listening, empathy, and motivational techniques. They create a safe and supportive environment where individuals feel comfortable exploring their financial challenges and developing solutions.

Empowering Individuals to Take Control

Finance coaches act as catalysts for change, empowering individuals to take ownership of their finances and make informed decisions. They do this by:

- Developing Personalized Financial Plans:A finance coach collaborates with individuals to define their financial goals, assess their current financial situation, and develop a customized plan to achieve those goals. This plan may include strategies for budgeting, saving, investing, and debt management.

- Providing Ongoing Support and Accountability:Finance coaches offer regular check-ins and support to help individuals stay on track with their financial plans. They provide encouragement, hold individuals accountable for their financial commitments, and adjust plans as needed.

- Building Financial Confidence:By providing knowledge, guidance, and support, finance coaches help individuals build confidence in their ability to manage their finances effectively. This increased confidence can lead to more informed and empowered financial decision-making.

Key Services Offered by a Finance Coach

A finance coach provides a range of services designed to help individuals achieve their financial goals. These services are tailored to meet the unique needs and circumstances of each client, offering guidance and support throughout their financial journey.

Financial Planning

A finance coach can help clients develop a comprehensive financial plan that Artikels their short-term and long-term goals, strategies to achieve those goals, and a roadmap for managing their finances effectively.

A Finance Coach can help you navigate the complex world of financial planning, including understanding your insurance needs. A key component of a well-rounded financial plan is adequate insurance coverage, and homeowners in Rhode Island should consult Rhode Island Home Insurance Quotes: A Guide for Homeowners to ensure they have the right protection for their property.

A Finance Coach can then help you integrate your insurance premiums into your overall financial strategy, ensuring you’re prepared for any unforeseen events.

| Service | Description | Benefits | Example |

|---|---|---|---|

| Budgeting and Expense Tracking | Analyzing income and expenses to create a realistic budget that aligns with financial goals. | Helps identify areas for saving and prioritize spending, reducing financial stress and promoting financial stability. | A finance coach can help a client track their spending habits and identify areas where they can cut back, such as reducing dining out expenses or negotiating lower bills. |

| Debt Management | Developing strategies to manage and reduce debt, such as creating a debt repayment plan or exploring debt consolidation options. | Reduces interest payments, improves credit score, and frees up cash flow for other financial goals. | A finance coach can help a client prioritize their debts and create a plan to pay them off faster, such as using the snowball or avalanche method. |

| Investment Planning | Developing an investment strategy that aligns with risk tolerance and financial goals, including asset allocation and diversification. | Helps clients grow their wealth, achieve long-term financial security, and potentially reach financial independence. | A finance coach can help a client create a diversified investment portfolio that includes stocks, bonds, and real estate, tailored to their risk tolerance and time horizon. |

| Retirement Planning | Assessing retirement goals, estimating future expenses, and developing a plan to ensure financial security in retirement. | Helps clients prepare for their retirement years with confidence, knowing they have a plan in place to meet their needs. | A finance coach can help a client determine how much they need to save for retirement, identify potential sources of income, and develop a plan to maximize their retirement savings. |

Financial Education

Finance coaches educate clients on various financial concepts, providing the knowledge and skills needed to make informed financial decisions.

“Financial literacy is the foundation of financial well-being.”

Finance coaches play a vital role in helping individuals achieve their financial goals, including navigating the often-complex world of insurance. For military members seeking boat insurance, USAA offers specialized coverage tailored to their unique needs. Boat Insurance Quote USAA: A Guide for Military Members provides a comprehensive overview of USAA’s offerings, allowing finance coaches to advise clients on the best options for their specific circumstances.

| Service | Description | Benefits | Example |

|---|---|---|---|

| Financial Literacy Training | Providing workshops or one-on-one sessions on topics such as budgeting, saving, investing, and debt management. | Empowers clients to make informed financial decisions, improves financial confidence, and reduces the risk of financial mistakes. | A finance coach can provide training on how to create a budget, understand credit scores, and invest in the stock market. |

| Financial Goal Setting | Helping clients define their financial goals, set realistic targets, and develop strategies to achieve them. | Provides direction and motivation, helps clients stay focused on their financial aspirations, and promotes accountability. | A finance coach can help a client set a goal to save for a down payment on a house, pay off student loans, or start a business. |

| Financial Risk Management | Assessing and mitigating financial risks, such as insurance coverage, emergency funds, and estate planning. | Protects clients from financial setbacks, provides peace of mind, and helps them prepare for unexpected events. | A finance coach can help a client review their insurance coverage, create an emergency fund, and develop an estate plan. |

The Benefits of Financial Coaching

Financial coaching offers a comprehensive approach to personal finance, encompassing both the practical and emotional aspects of money management. By working with a certified financial coach, individuals can gain valuable insights, develop positive habits, and achieve their financial goals more effectively.

Psychological and Emotional Benefits of Financial Coaching

Financial coaching can significantly impact individuals’ mental and emotional well-being by addressing the psychological and emotional aspects of money management.

Finance coaches can help you navigate the complexities of financial planning, from budgeting and saving to investing and insurance. A crucial component of any financial plan is ensuring adequate insurance coverage, and Get a USAA Insurance Quote: A Comprehensive Guide provides valuable insights into the process.

By understanding your insurance needs, you can work with your finance coach to create a robust financial strategy that protects your assets and secures your future.

- Reduced Financial Stress:Financial concerns are a leading source of stress for many people. Financial coaching provides a safe and supportive environment to discuss financial worries, develop strategies to alleviate them, and create a plan to manage debt, leading to reduced stress levels and improved mental health.

- Increased Financial Confidence:Financial coaching helps individuals gain a better understanding of their financial situation, develop budgeting skills, and make informed financial decisions. This increased knowledge and control over their finances can boost confidence and reduce feelings of anxiety or overwhelm.

- Improved Emotional Well-being:By addressing financial anxieties and developing a clear financial plan, financial coaching can positively impact overall emotional well-being. Individuals may experience a sense of accomplishment, empowerment, and peace of mind, leading to improved mood and overall life satisfaction.

Fostering Positive Behavioral Changes Related to Money Management, Finance Coach for Financial Planning and Education

Financial coaching plays a crucial role in promoting positive behavioral changes related to money management.

- Developing Healthy Financial Habits:Financial coaches guide individuals in establishing and maintaining healthy financial habits, such as budgeting, saving, and investing. By working with a coach, individuals can develop a more conscious and responsible approach to their finances.

- Overcoming Financial Obstacles:Financial coaches help individuals identify and overcome financial obstacles, such as impulsive spending, debt accumulation, or lack of financial knowledge. Through personalized guidance and support, individuals can develop strategies to address these challenges and make progress towards their financial goals.

- Accountability and Motivation:Financial coaches provide accountability and motivation, encouraging individuals to stick to their financial plans and make progress towards their goals. Regular check-ins and support from a coach can help individuals stay on track and avoid procrastination.

Success Stories and Testimonials

- Case Study: Sarah, a single mother struggling with debt, worked with a financial coach to develop a debt management plan and create a budget that allowed her to save for her children’s education. She reported a significant reduction in stress and an increased sense of control over her finances.

- Testimonial: John, a young professional, stated, “Working with a financial coach helped me develop a clear financial plan and prioritize my savings goals. I feel more confident about my financial future and am excited to achieve my long-term goals.”

Finding and Choosing the Right Finance Coach

Finding the right financial coach is crucial for achieving your financial goals. A good coach can provide guidance, support, and accountability, helping you navigate the complexities of personal finance.

Factors to Consider When Selecting a Finance Coach

To find the best fit, it’s essential to consider several factors.

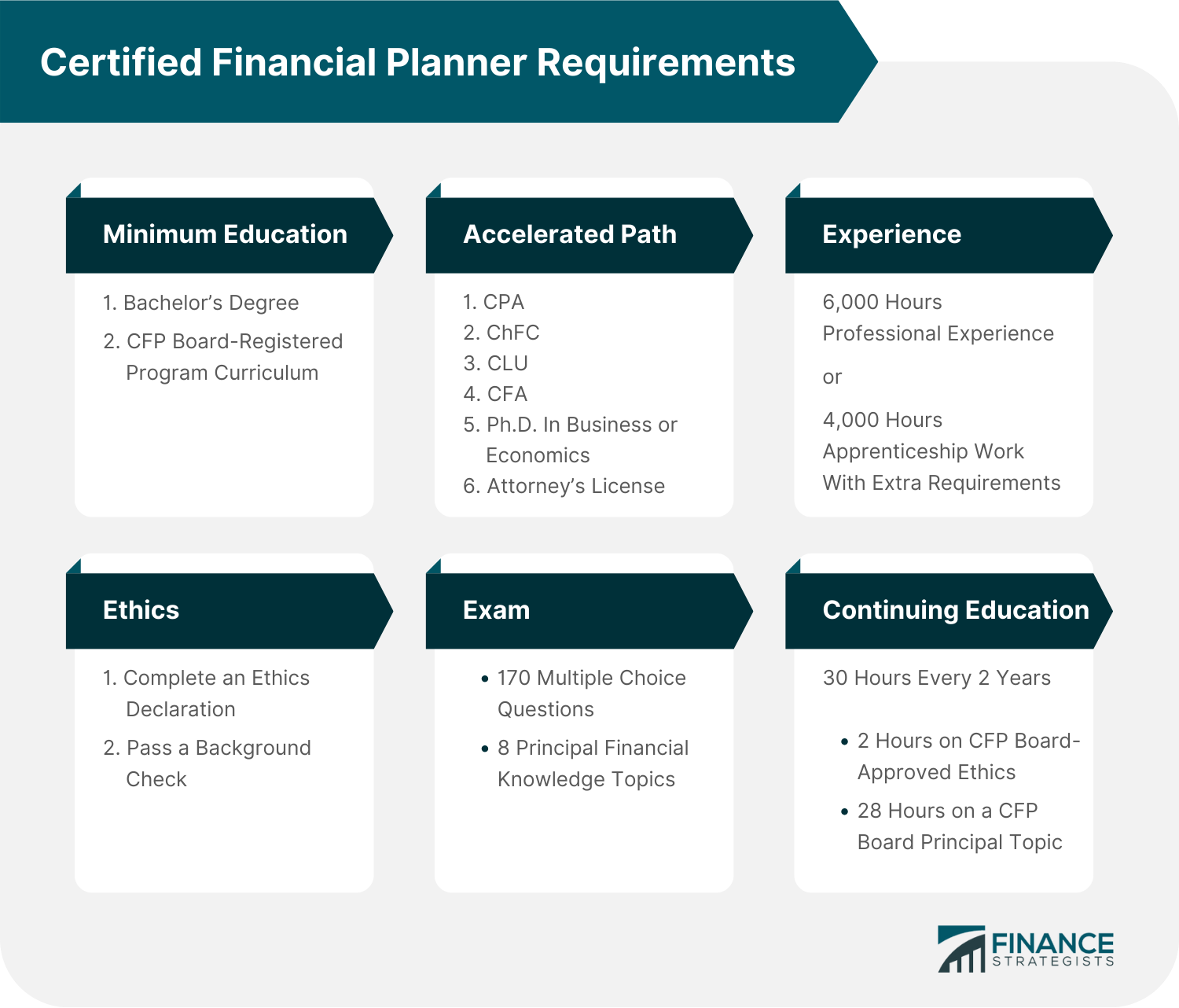

- Experience and Qualifications:Look for coaches with relevant certifications and experience in financial planning, investment management, or related fields. A certified financial planner (CFP®) or a chartered financial consultant (ChFC®) is a good indicator of their expertise.

- Areas of Expertise:Determine the specific financial areas where you need guidance, such as budgeting, debt management, investing, or retirement planning. Choose a coach with experience in those areas.

- Communication Style:A good coach should be able to communicate clearly and effectively, tailoring their explanations to your understanding. Consider their communication style and how well you connect with them.

- Fees and Services:Understand the coach’s fee structure, payment options, and the services included in their package. Consider the value they offer in relation to their fees.

- Client Testimonials:Look for testimonials from previous clients to gauge their satisfaction and the coach’s track record.

- Professionalism and Ethics:Ensure the coach adheres to ethical standards and practices, including confidentiality and transparency.

Establishing Rapport and Trust

Building rapport and trust with your finance coach is essential for a successful relationship.

- Initial Consultation:Schedule a free consultation to discuss your financial goals, needs, and expectations. This allows you to assess their personality, communication style, and whether you feel comfortable working with them.

- Open Communication:Be open and honest with your coach about your financial situation, goals, and concerns. This allows them to provide tailored advice and support.

- Active Listening:A good coach will actively listen to your needs and respond with empathy and understanding.

Determining Qualifications and Experience

Evaluate the coach’s qualifications and experience to ensure they have the necessary knowledge and expertise to guide you.

- Certifications:Look for relevant certifications, such as CFP®, ChFC®, or other financial planning credentials.

- Professional Affiliations:Check if the coach belongs to professional organizations like the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA).

- Experience:Inquire about the coach’s experience in working with clients similar to you and their track record in achieving financial goals.

- Continuing Education:A commitment to ongoing education demonstrates a coach’s dedication to staying up-to-date with the latest financial trends and best practices.

Epilogue: Finance Coach For Financial Planning And Education

In today’s complex financial landscape, having a Finance Coach for Financial Planning and Education by your side can be invaluable. Whether you’re looking to manage debt, plan for retirement, or simply gain control of your finances, a skilled finance coach can provide the support, guidance, and accountability you need to reach your goals.

Embrace the power of financial coaching and embark on a journey towards a brighter financial future.