Budgeting Tips and Strategies for Financial Success are essential for achieving long-term financial security. Whether you’re looking to save for retirement, pay off debt, or simply gain control over your finances, understanding the fundamentals of budgeting is crucial. By taking a proactive approach to managing your money, you can build a solid foundation for a brighter financial future.

This guide will explore various budgeting strategies, from tracking income and expenses to setting realistic financial goals and creating a budget that aligns with your aspirations. We’ll delve into practical tips for managing expenses, building an emergency fund, and exploring investment options to help you make informed financial decisions.

Understanding Your Finances

Taking control of your finances starts with a clear understanding of your financial landscape. This involves knowing where your money comes from and where it goes.

Tracking Income and Expenses

Tracking income and expenses is crucial for understanding your financial situation. This involves recording all sources of income, such as salary, investments, and side hustles, as well as all expenses, including rent, utilities, groceries, and entertainment.

Tracking your income and expenses provides valuable insights into your spending habits and helps you identify areas where you can save money.

There are various methods for tracking income and expenses. Some popular options include:

- Spreadsheets:Create a simple spreadsheet to manually track your income and expenses. This method offers flexibility and control over data organization.

- Budgeting Apps:Utilize budgeting apps that automatically categorize transactions and provide insights into spending patterns. These apps offer convenience and real-time updates.

- Manual Tracking:Use a notebook or journal to manually record your income and expenses. This method allows for greater detail and personalization.

The Importance of a Budget, Budgeting Tips and Strategies for Financial Success

A budget is a financial plan that Artikels how you will allocate your income to cover your expenses and achieve your financial goals.

Budgeting tips and strategies are essential for financial success, and protecting your assets is a crucial part of that equation. When it comes to your home, securing adequate insurance is vital. Rhode Island homeowners can find a comprehensive guide to obtaining competitive quotes and navigating the insurance process at Rhode Island Home Insurance Quotes: A Guide for Homeowners.

By carefully considering your coverage needs and exploring available options, you can ensure your home is protected while staying within your budget.

A budget helps you prioritize spending, avoid unnecessary expenses, and achieve financial stability.

It provides a framework for managing your money effectively, ensuring that you have enough funds for essential needs and savings for future goals.

Budgeting Methods

There are numerous budgeting methods available, each with its unique approach. Here are two popular examples:

The 50/30/20 Rule

The 50/30/20 rule is a simple budgeting method that divides your after-tax income into three categories:

- 50% for Needs:This category covers essential expenses like housing, utilities, groceries, and transportation.

- 30% for Wants:This category includes discretionary spending, such as entertainment, dining out, and hobbies.

- 20% for Savings and Debt Repayment:This category allocates funds for emergency savings, retirement planning, and debt reduction.

The Zero-Based Budget

The zero-based budget method involves allocating every dollar of your income to a specific category. This method emphasizes a detailed approach to budgeting, ensuring that all income is accounted for.

The zero-based budget encourages conscious spending and eliminates unnecessary expenses.

It requires careful planning and tracking to ensure that all expenses are covered within the allocated budget.

Setting Financial Goals

Financial goals provide a roadmap for your financial journey, guiding you towards financial success. They act as a compass, directing your decisions and motivating you to stay on track. Setting clear, well-defined financial goals is crucial for achieving your aspirations.

SMART Financial Goals

Financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This framework helps ensure your goals are well-defined and actionable.

- Specific: Clearly define what you want to achieve. For instance, instead of “save money,” specify “save $10,000 for a down payment on a house.”

- Measurable: Quantify your goals. Instead of “pay off debt,” specify “reduce my credit card debt by $5,000.”

- Achievable: Set realistic goals that you can reasonably accomplish. Don’t aim for the impossible; set attainable targets.

- Relevant: Ensure your goals align with your overall financial objectives and life priorities.

- Time-bound: Set deadlines for achieving your goals. This provides a sense of urgency and helps you stay on track.

Types of Financial Goals

Financial goals can encompass various aspects of your financial life, including:

| Goal | Timeline | Action Plan |

|---|---|---|

| Save for Retirement | Long-term (20+ years) | Contribute regularly to a retirement savings account, such as a 401(k) or IRA. Consider increasing contributions as your income grows. Seek professional advice to develop an investment strategy aligned with your risk tolerance and time horizon. |

| Buy a Home | Mid-term (5-10 years) | Save for a down payment. Improve your credit score. Research mortgage options and pre-qualify for a loan. Consider attending homebuyer education classes. |

| Pay Off Debt | Short-term (1-5 years) | Create a debt repayment plan, prioritizing high-interest debt. Consider debt consolidation or balance transfers to lower interest rates. Increase your income or reduce expenses to free up cash flow for debt repayment. |

| Fund Your Child’s Education | Long-term (18+ years) | Start saving early. Consider a 529 college savings plan. Explore financial aid options and scholarships. |

| Emergency Fund | Short-term (3-6 months) | Build a savings account with enough to cover 3-6 months of living expenses. This provides a financial cushion for unexpected events, such as job loss or medical emergencies. |

Creating a Budget: Budgeting Tips And Strategies For Financial Success

A budget is a financial roadmap that helps you manage your money effectively and achieve your financial goals. It Artikels how you plan to spend and save your income, ensuring you stay on track and avoid overspending. Creating a realistic budget requires a clear understanding of your income and expenses.

A key aspect of financial success is managing your expenses effectively, and insurance premiums can significantly impact your budget. To ensure you’re getting the best value for your money, it’s essential to shop around and compare quotes from different insurers.

Get a USAA Insurance Quote: A Comprehensive Guide provides valuable insights on how to obtain competitive quotes and understand the different coverage options available. By taking advantage of these resources, you can make informed decisions about your insurance needs and allocate your budget wisely.

Budgeting Tools and Apps

Budgeting tools and apps can simplify the process of tracking your income and expenses. These tools offer features like expense tracking, budgeting categories, financial reports, and goal setting. They can also provide insights into your spending habits and help you identify areas where you can cut back.

- Personal Finance Management Software:Mint, Personal Capital, and YNAB (You Need a Budget) offer comprehensive financial management solutions, including budgeting, expense tracking, and investment management. They can connect to your bank accounts and credit cards to automatically track transactions.

- Budgeting Apps:Simple budgeting apps like EveryDollar, PocketGuard, and Goodbudget focus on helping you allocate your income to different categories and track your spending.

- Spreadsheet Software:If you prefer a more hands-on approach, you can create a budget using spreadsheet software like Microsoft Excel or Google Sheets.

Categorizing Expenses and Allocating Funds

Categorizing expenses helps you understand where your money is going and identify areas where you can potentially save. Once you have a clear picture of your spending, you can allocate funds to different categories based on your financial goals and priorities.

While budgeting tips and strategies are crucial for financial success, it’s also essential to consider specific financial needs. For example, if you’re a military member who enjoys boating, securing the right insurance is vital. Boat Insurance Quote USAA: A Guide for Military Members provides valuable information on securing affordable and comprehensive coverage for your vessel.

By incorporating such specific needs into your budgeting plan, you can achieve greater financial stability and peace of mind.

- Fixed Expenses:These are recurring expenses that remain relatively constant each month, such as rent, mortgage payments, utilities, and insurance premiums.

- Variable Expenses:These are expenses that fluctuate from month to month, such as groceries, entertainment, dining out, and clothing.

- Discretionary Expenses:These are non-essential expenses that you can choose to cut back on, such as subscriptions, hobbies, and travel.

The 50/30/20 rule is a popular budgeting guideline. It suggests allocating 50% of your after-tax income to needs (fixed expenses), 30% to wants (variable expenses), and 20% to savings and debt repayment.

Managing Expenses

Once you have a clear picture of your income and spending, the next step is to manage your expenses effectively. This involves identifying areas where you might be overspending and implementing strategies to reduce unnecessary costs.

Identifying Common Areas of Overspending

Many people find themselves overspending in certain categories without realizing it. Understanding these common areas can help you pinpoint where to focus your efforts on reducing expenses.

- Dining Out:Eating out frequently can significantly impact your budget. Consider cooking more meals at home, opting for less expensive restaurants, or taking advantage of discounts and deals.

- Shopping:Impulse purchases and unnecessary items can quickly drain your bank account. Make a list before shopping, stick to your budget, and avoid browsing stores when you’re not looking for anything specific.

- Entertainment:Movies, concerts, and other entertainment activities can be costly. Look for free or discounted options, such as parks, museums, or community events.

- Subscriptions:Many people subscribe to services they don’t use regularly or have forgotten about. Review your subscriptions and cancel any you don’t need.

- Transportation:Fuel, parking, and public transportation can add up. Consider carpooling, biking, or walking when possible, and use public transportation or ride-sharing services strategically.

Negotiating Bills and Finding Better Deals

Negotiating your bills and finding better deals can save you a significant amount of money over time. Many companies are willing to work with customers to find solutions that benefit both parties.

- Contact your service providers:Call your internet, phone, cable, and insurance providers to inquire about discounts, promotions, or better rates. Be prepared to discuss your needs and compare offers from different companies.

- Negotiate your credit card interest rates:If you have high-interest credit card debt, contact your issuer and request a lower rate. Be sure to have a good payment history and a plan to pay down your debt.

- Shop around for better deals:Compare prices for insurance, utilities, and other services to ensure you’re getting the best rates. Many websites and apps allow you to compare quotes from different providers.

Saving Money on Everyday Expenses

Small changes in your daily habits can add up to substantial savings over time. Here are some tips for saving money on groceries, transportation, and entertainment:

- Groceries:

- Plan your meals:Creating a weekly meal plan can help you avoid impulse purchases and stick to your grocery list.

- Shop at discount stores:Consider shopping at discount grocery stores or warehouse clubs for bulk purchases.

- Buy generic brands:Generic brands often offer the same quality as name brands at a lower price.

- Use coupons and store loyalty programs:Take advantage of coupons and discounts offered by your favorite stores.

- Cook at home:Eating out less frequently can save you a significant amount of money.

- Transportation:

- Walk, bike, or carpool:Consider alternative transportation options to reduce your reliance on driving.

- Use public transportation:Public transportation can be a more affordable option than driving, especially in urban areas.

- Combine errands:Plan your errands to minimize the amount of driving you need to do.

- Maintain your vehicle:Regular maintenance can help improve fuel efficiency and reduce the risk of costly repairs.

- Entertainment:

- Take advantage of free events:Many cities offer free concerts, festivals, and other events.

- Explore local parks and museums:Parks and museums often offer free or discounted admission days.

- Host a game night or movie night:Gather friends and family for a fun and affordable night in.

- Use streaming services:Streaming services can provide access to a wide variety of movies, TV shows, and music for a monthly fee.

Saving and Investing

Saving and investing are crucial components of financial success. By setting aside a portion of your income and investing it wisely, you can build wealth over time, achieve your financial goals, and secure your future.

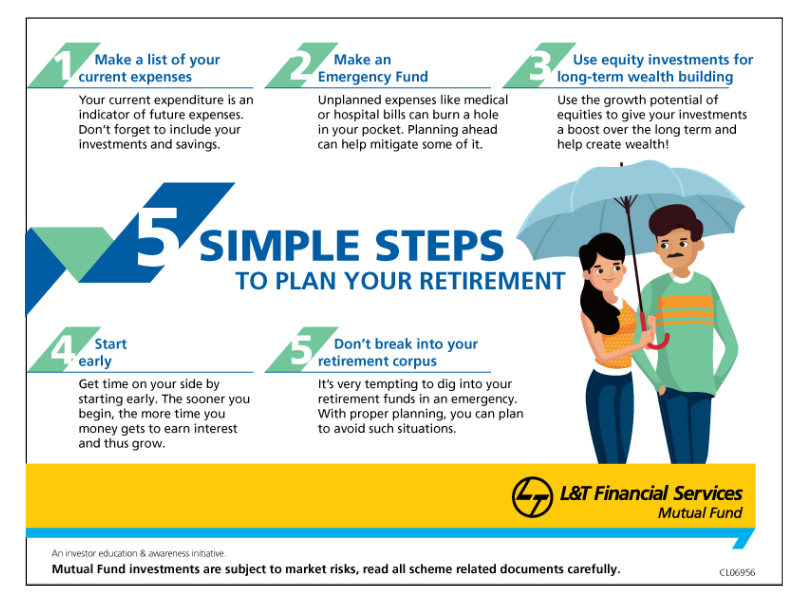

Building an Emergency Fund

An emergency fund is a vital safety net that provides financial stability during unexpected events such as job loss, medical emergencies, or car repairs. It is recommended to have 3-6 months’ worth of living expenses saved in an easily accessible account, such as a high-yield savings account or money market account.

Strategies for Saving Money

- Set realistic savings goals: Determine a specific amount you want to save and set a timeline for achieving it. This will provide motivation and help you track your progress.

- Automate your savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This ensures consistent saving without requiring you to manually transfer funds.

- Reduce unnecessary expenses: Identify areas where you can cut back on spending, such as dining out, entertainment, or subscriptions. This frees up more money to allocate towards savings.

- Negotiate bills: Contact your service providers, such as your internet, cable, or insurance companies, to negotiate lower rates. You may be surprised at the savings you can achieve.

- Take advantage of employer-sponsored retirement plans: If your employer offers a 401(k) or similar plan, contribute as much as you can, especially if your employer offers a matching contribution.

Investment Options

Investing allows your money to grow over time, potentially outpacing inflation and generating higher returns than savings accounts.

Types of Investments

- Stocks: Represent ownership in a company and offer the potential for high returns, but also carry higher risk.

- Bonds: Debt securities issued by companies or governments, typically offering lower returns than stocks but with less risk.

- Mutual Funds: Pools of money from multiple investors that are invested in a diversified portfolio of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks.

- Real Estate: Can provide rental income and appreciation, but requires significant capital and involves ongoing management responsibilities.

Choosing the Right Investment Strategy

The best investment strategy depends on your individual risk tolerance, financial goals, and time horizon.

Factors to Consider

- Risk Tolerance: How comfortable are you with the potential for losses? Higher-risk investments offer the potential for greater returns, but also carry a greater chance of losing money.

- Financial Goals: What are you saving for? Short-term goals, such as a down payment on a house, may require more conservative investments, while long-term goals, such as retirement, can accommodate higher-risk investments.

- Time Horizon: How long do you plan to invest your money? Longer time horizons allow for greater potential growth and can mitigate the impact of market fluctuations.

Ultimate Conclusion

Mastering budgeting techniques empowers you to take control of your financial destiny. By understanding your spending habits, setting clear goals, and implementing strategies to save and invest wisely, you can unlock a path toward financial freedom. Remember, the journey to financial success starts with a commitment to budgeting and a disciplined approach to managing your money.