Auto Insurance Online Quotes and Comparison: A Guide to Saving Money offers a comprehensive overview of navigating the digital world of auto insurance. This guide equips you with the tools and knowledge to compare quotes, understand coverage options, and ultimately find the best policy for your needs.

Gone are the days of tedious phone calls and lengthy paperwork. Today, the power of the internet allows you to compare quotes from multiple insurers in minutes, empowering you to make informed decisions about your auto insurance.

The article delves into the benefits of obtaining online quotes, including the time-saving aspect and the convenience of comparing quotes side-by-side. It then explores key factors to consider when comparing quotes, such as coverage options, deductibles, and premium rates. Understanding these factors is crucial to finding the best policy for your individual needs and budget.

The Convenience of Online Auto Insurance Quotes

In today’s digital age, obtaining auto insurance quotes has become remarkably convenient. The process of comparing rates and securing coverage is now streamlined and accessible from the comfort of your own home. Online platforms have revolutionized the way individuals shop for auto insurance, offering a host of benefits that make the process efficient and user-friendly.

The Time-Saving Aspects of Online Quote Comparison

One of the most significant advantages of obtaining auto insurance quotes online is the substantial time savings it offers. Unlike traditional methods, which often involve phone calls, in-person visits, and lengthy paperwork, online platforms allow you to compare quotes from multiple insurers in a matter of minutes.

The ability to quickly and efficiently gather information from various providers eliminates the need for tedious phone calls and waiting periods.

How to Obtain Online Quotes

Obtaining online auto insurance quotes is a straightforward process. You can follow these steps to get started:

- Visit an Online Insurance Comparison Website:Several reputable websites specialize in comparing auto insurance quotes from different providers. These platforms typically allow you to enter your personal information, including your driving history, vehicle details, and desired coverage.

- Provide Your Information:The websites will ask for essential details about yourself and your vehicle, such as your age, driving history, vehicle make and model, and desired coverage levels. This information helps insurers assess your risk and generate personalized quotes.

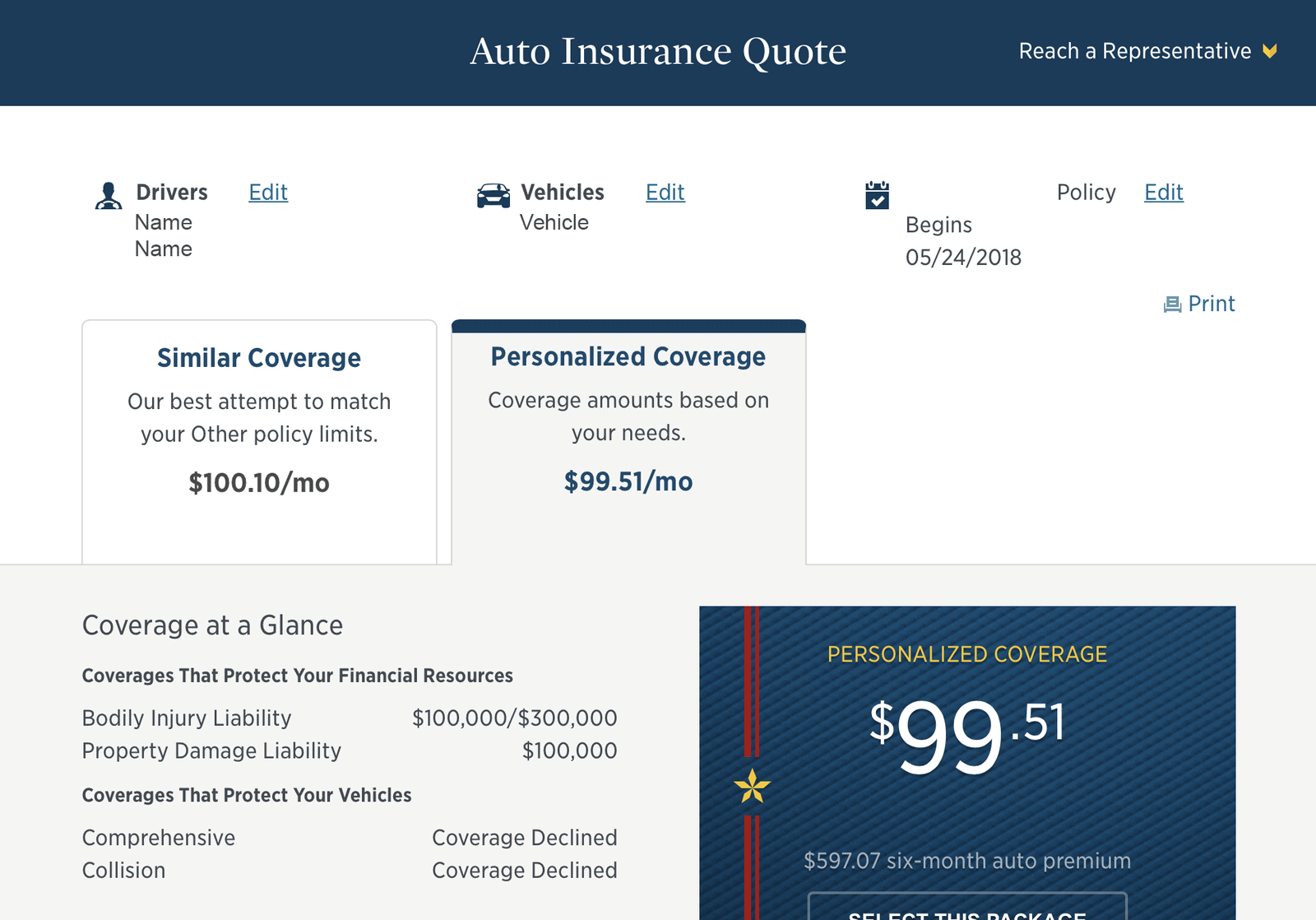

- Compare Quotes:Once you submit your information, the comparison website will display a list of quotes from different insurers, allowing you to easily compare rates, coverage options, and other factors. This allows you to identify the best value for your needs.

- Review and Choose:Carefully review the quotes presented, paying attention to the coverage details, deductibles, and any additional fees or discounts offered. Select the quote that best meets your requirements and budget.

- Contact the Insurer:After choosing a quote, you can contact the insurer directly to finalize the policy and obtain coverage. Most online platforms allow you to purchase the policy directly through their website, further simplifying the process.

Comparing Auto Insurance Quotes: Auto Insurance Online Quotes And Comparison

Once you’ve gathered quotes from various insurance providers, it’s time to compare them carefully. This step is crucial for finding the best coverage at a price that fits your budget.

Factors to Consider When Comparing Auto Insurance Quotes

Comparing quotes involves more than just looking at the bottom line. You need to consider several factors to ensure you’re getting the right coverage for your needs.

- Coverage Options:Each provider offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Make sure you understand the differences and choose the level of protection that suits your needs and risk tolerance.

- Deductibles:Your deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically lead to lower premiums, but you’ll pay more in the event of an accident. Choose a deductible you can comfortably afford.

- Discounts:Many insurance companies offer discounts for safe driving, good credit, multiple vehicles, and other factors. Check with each provider to see what discounts you qualify for.

- Customer Service:Consider the insurer’s reputation for customer service. Read online reviews and check with the Better Business Bureau to get a sense of how responsive and helpful they are.

- Financial Stability:It’s essential to choose an insurer with a strong financial rating. A company with a good financial rating is more likely to be able to pay claims when you need them. You can check the financial ratings of insurance companies through organizations like A.M.

Best or Standard & Poor’s.

Comparing Coverage Options

Each insurance company offers a range of coverage options. Understanding these options is crucial for making informed decisions about your auto insurance.

- Liability Coverage:This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It’s typically required by law, and the minimum coverage amounts vary by state.

- Collision Coverage:This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who’s at fault. Collision coverage is optional, but it’s essential if you have a financed or leased vehicle.

- Comprehensive Coverage:This coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. Comprehensive coverage is also optional, but it can be beneficial if you have a newer or high-value vehicle.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. Uninsured/underinsured motorist coverage is optional but can be crucial in protecting yourself financially.

Comparing Insurance Providers

Here’s a table comparing some key features of different auto insurance providers:

| Provider | Average Premium | Discounts | Customer Service Rating | Financial Rating |

|---|---|---|---|---|

| Provider A | $1,200/year | Safe Driver, Good Student, Multi-Car | 4.5 stars | A+ |

| Provider B | $1,000/year | Safe Driver, Good Credit, Multi-Car | 4 stars | A |

| Provider C | $1,100/year | Safe Driver, Good Student, Multi-Car, Homeowner | 3.5 stars | A- |

Understanding Auto Insurance Coverage

Auto insurance is a complex topic with many different types of coverage available. Understanding the various options can help you choose the right coverage for your needs and budget.

Liability Coverage

Liability coverage is the most important type of auto insurance. It protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. Liability coverage is usually divided into two parts: bodily injury liability and property damage liability.

- Bodily injury liabilitycovers medical expenses, lost wages, and other damages for injuries caused to others in an accident.

- Property damage liabilitycovers damages to another person’s vehicle or property, such as a fence or building, if you are at fault in an accident.

The amount of liability coverage you need depends on several factors, including your state’s minimum requirements, your assets, and your risk tolerance.

It is important to have enough liability coverage to protect your assets in case of a serious accident.

Auto insurance online quotes and comparison tools offer a convenient way to shop around for the best rates, but navigating the process can be overwhelming. For military members and their families, Get a USAA Insurance Quote: A Comprehensive Guide can provide valuable insights into the specific coverage options and discounts available through USAA.

This information can then be used to compare against other quotes and make an informed decision about your auto insurance needs.

Collision Coverage

Collision coverage pays for damages to your vehicle if you are involved in an accident, regardless of who is at fault. This coverage is optional and can help you pay for repairs or replacement of your vehicle if you are involved in a collision with another vehicle, a stationary object, or even a pothole.

The convenience of comparing auto insurance quotes online has revolutionized the way consumers shop for coverage. This same ease of comparison can be applied to boat insurance, particularly for military members who may benefit from the specialized services offered by USAA.

Boat Insurance Quote USAA: A Guide for Military Members provides a comprehensive overview of USAA’s offerings, allowing individuals to assess their needs and find the best coverage for their vessel. Once you’ve explored boat insurance options, returning to the online comparison tools for auto insurance can help you secure the most competitive rates for your vehicle.

- Collision coverage is usually optional, but it can be beneficial if you have a new or financed vehicle.

- If you have an older vehicle, you may decide to waive collision coverage because the cost of repairs may exceed the value of the vehicle.

Comprehensive Coverage

Comprehensive coverage pays for damages to your vehicle caused by events other than a collision, such as theft, vandalism, fire, hail, or flood. This coverage is also optional and can help you pay for repairs or replacement of your vehicle if it is damaged by a covered event.

- Comprehensive coverage is especially important if you live in an area that is prone to natural disasters or if you have a vehicle that is valuable or difficult to replace.

- If you have an older vehicle, you may decide to waive comprehensive coverage because the cost of repairs may exceed the value of the vehicle.

Factors Affecting Auto Insurance Premiums

Auto insurance premiums are calculated based on a variety of factors, each contributing to the overall cost of your policy. Understanding these factors can help you make informed decisions to potentially lower your premiums.

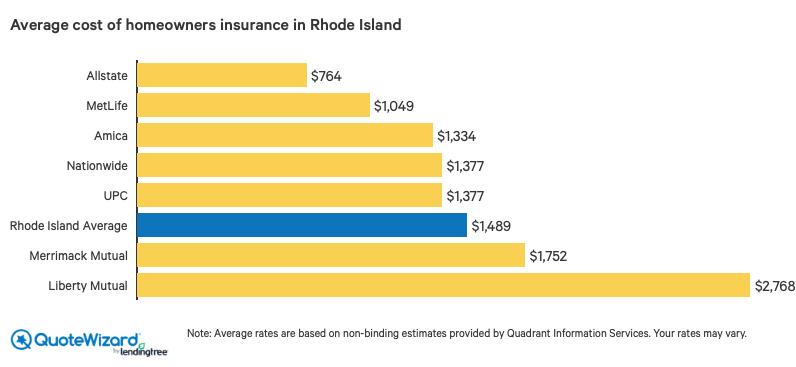

Consumers are increasingly turning to online platforms to compare and purchase auto insurance, seeking the best rates and coverage options. This same convenience extends to home insurance, and Rhode Island residents can leverage online tools to find the right policy for their needs.

A comprehensive guide to Rhode Island home insurance quotes can be found here , offering insights on factors influencing premiums and navigating the process of securing coverage. The ease of online comparison allows individuals to confidently navigate both auto and home insurance decisions, ensuring they receive the most competitive rates and comprehensive protection.

Driving History

Your driving history is a significant factor in determining your auto insurance premiums. A clean driving record with no accidents or traffic violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

Insurance companies view drivers with a history of risky behavior as more likely to file claims, thus increasing their costs.

Vehicle Type, Auto Insurance Online Quotes and Comparison

The type of vehicle you drive plays a crucial role in your auto insurance premiums. Factors such as the vehicle’s make, model, year, and safety features all influence the cost. Luxury vehicles, sports cars, and high-performance vehicles are often more expensive to insure due to their higher repair costs and greater risk of theft.

Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts as they reduce the likelihood of accidents and injuries.

Location

Your location also affects your auto insurance premiums. Insurance companies consider factors such as the density of population, traffic congestion, crime rates, and the frequency of accidents in your area. Urban areas with high traffic volumes and congested roads generally have higher premiums than rural areas with lower traffic density.

Additionally, areas with higher crime rates may see increased insurance premiums due to the higher risk of theft and vandalism.

Choosing the Right Auto Insurance Provider

Selecting the right auto insurance provider is crucial for ensuring you have adequate coverage at a competitive price. While online comparison tools can help you find the best deals, making an informed decision involves considering factors beyond just the premium.

Customer Service

Customer service is a vital aspect of the insurance experience, particularly during claims processing. It’s essential to choose a provider known for its responsiveness, helpfulness, and ease of communication.

- Look for providers with positive customer reviews and high ratings from independent organizations.

- Consider the availability of multiple communication channels, such as phone, email, and online chat, for convenience.

- Assess the provider’s track record in handling claims promptly and fairly.

Financial Stability

Financial stability is paramount for any insurance provider, as it ensures they can pay out claims when needed.

- Check the provider’s financial ratings from agencies like A.M. Best or Moody’s. A strong rating indicates a financially sound company with a good history of paying claims.

- Research the provider’s history of solvency and any recent financial difficulties or regulatory actions.

- Avoid providers with a history of financial instability, as they may not be able to fulfill their obligations in the event of a major claim.

Claims Handling Processes

Understanding the claims handling process is essential for a smooth and efficient experience when you need to file a claim.

- Inquire about the provider’s claims process, including the required documentation, timelines, and available support options.

- Look for providers with a reputation for streamlined claims handling, efficient communication, and fair settlements.

- Consider the availability of online claim filing options and 24/7 claims support.

Reputable Auto Insurance Providers

- State Farm:Known for its extensive agent network, strong financial stability, and comprehensive coverage options.

- Geico:Offers competitive rates, a user-friendly online platform, and a wide range of coverage options.

- Progressive:Provides a personalized approach to insurance, with features like Snapshot telematics and Name Your Price tools.

- Allstate:Offers a variety of discounts and coverage options, with a focus on customer service and claims handling.

- USAA:Exclusively serves active and former military members and their families, known for its exceptional customer service and competitive rates.

Outcome Summary

Navigating the world of auto insurance can feel overwhelming, but with the right tools and knowledge, finding the best policy is achievable. By leveraging the convenience and accessibility of online quotes and comparison tools, you can save time, money, and ensure you have the right coverage for your vehicle and circumstances.

This guide empowers you to make informed decisions about your auto insurance, allowing you to find a policy that meets your needs and budget.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/6ZSXS37WCJABPPHK7A5HJAQBAY)